MISSION UPDATE

Q1 2024

Q1 2024

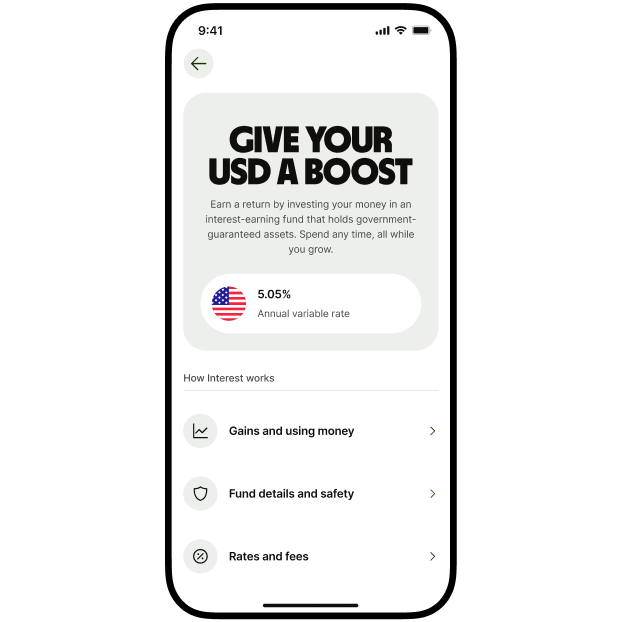

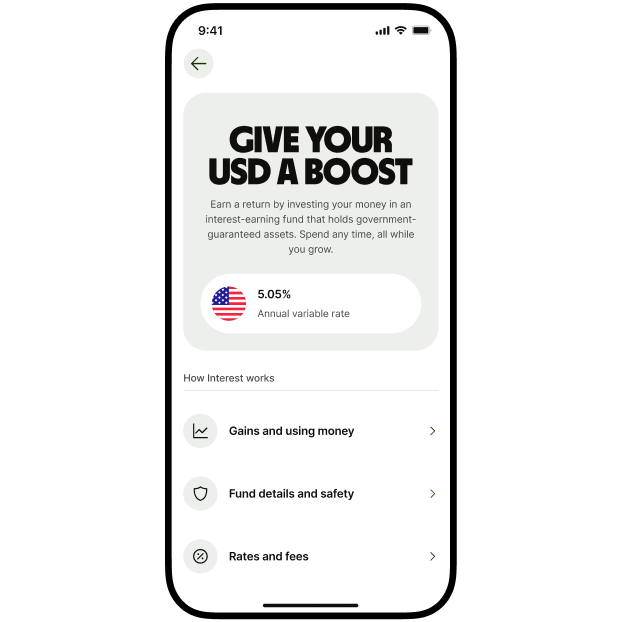

You can now boost your USD balance with a variable rate of 5.05%. Open a USD balance and switch it to Interest. Then watch your money grow through an investment in a low-risk fund of government-backed assets. Giving you higher rewards for lower stakes. Capital at risk. The fund has returned an 1.80% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

You can now boost your EUR and GBP balance with variable rates of 3.67% on EUR and 4.66% on GBP. Open a EUR or GBP balance and switch it to Interest. We’ll then invest it in a low-risk fund of government-backed assets, giving you higher rewards for lower stakes. Capital at risk. This fund has returned a 1.31% annual average on GBP and 0.14% on EUR annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

You can now boost your USD balance with a variable rate of 5.05%. Open a USD balance and switch it to Interest. Then watch your money grow through an investment in a low-risk fund of government-backed assets. Giving you higher rewards for lower stakes. Capital at risk. The fund has returned an 1.80% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

You can now boost your EUR and GBP balance with variable rates of 3.67% on EUR and 4.66% on GBP. Open a EUR or GBP balance and switch it to Interest. We’ll then invest it in a low-risk fund of government-backed assets, giving you higher rewards for lower stakes. Capital at risk. This fund has returned a 1.31% annual average on GBP and 0.14% on EUR annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

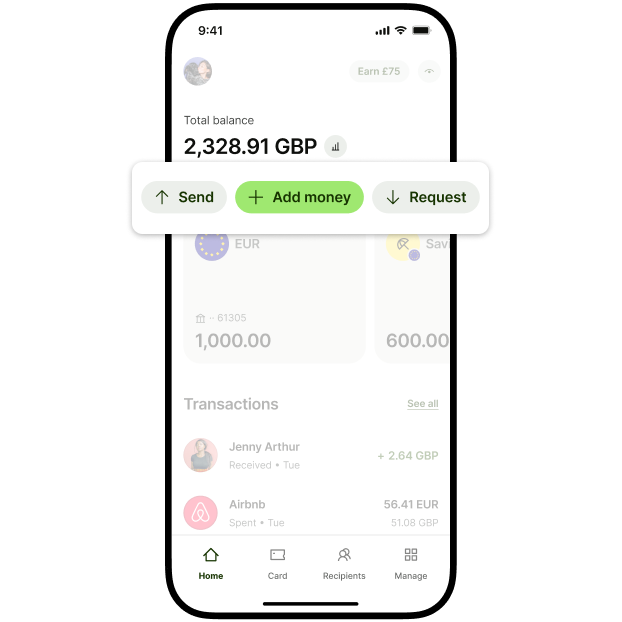

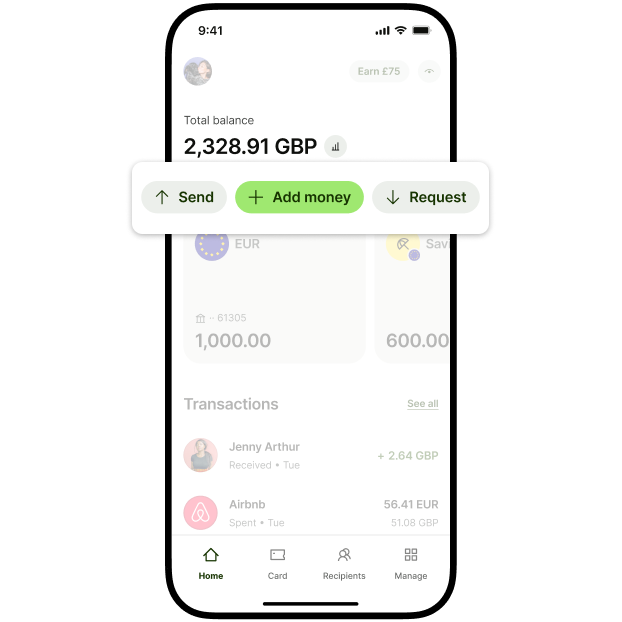

Say hello to a new and improved way of adding money. We’ve cut the amount of steps it takes to add money in half — and we’ll save your payment method to make it even quicker the next time around.

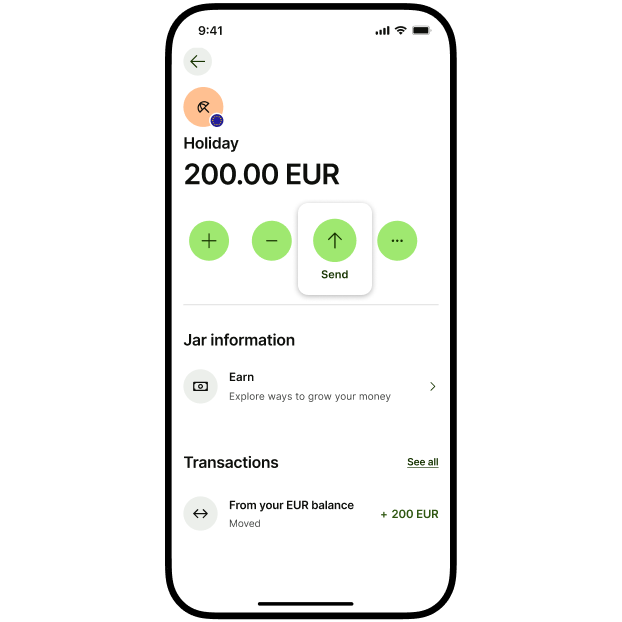

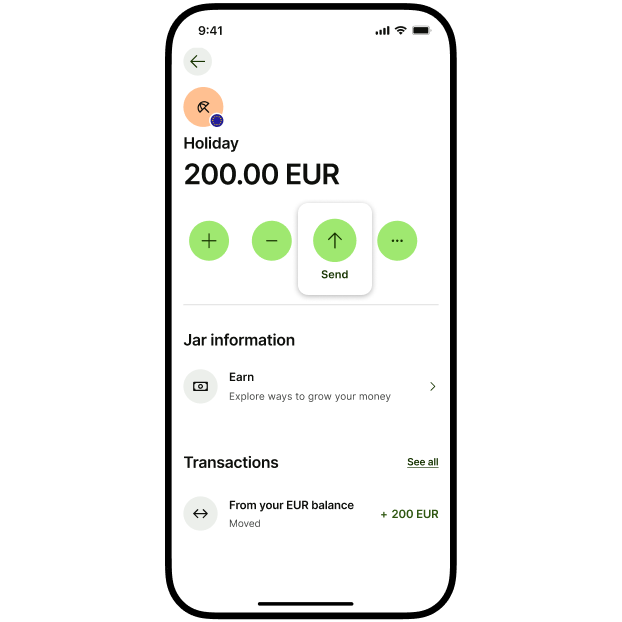

If you’ve got money set aside in a Jar, you can now send it straight from there, without needing to withdraw it to your balance first.

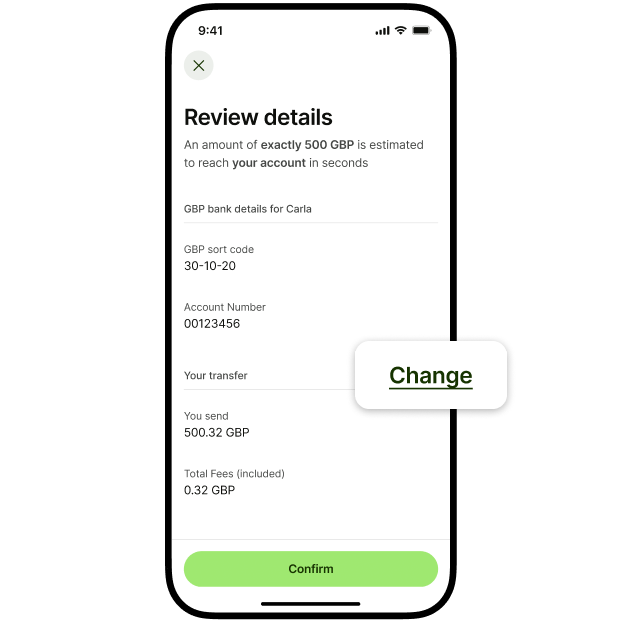

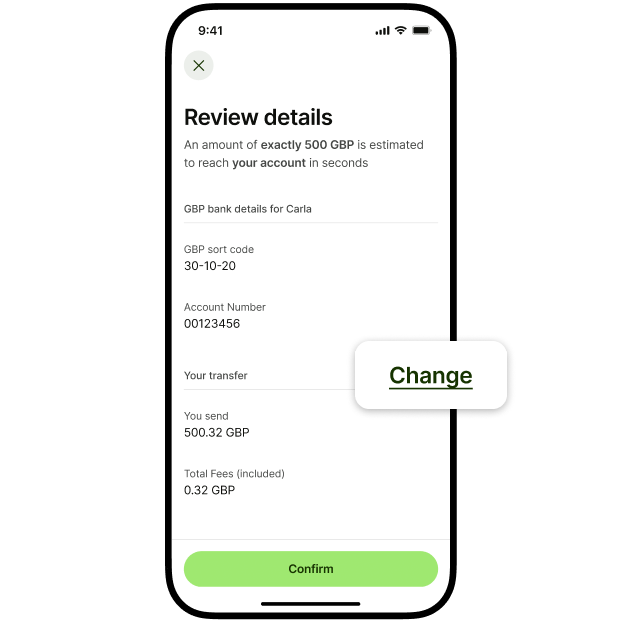

If you frequently pay the same person but different amounts each time, this one’s for you. You can now edit the amount on your repeat transfers. Just tap a previous transfer and select ‘change’.

Say hello to a new and improved way of adding money. We’ve cut the amount of steps it takes to add money in half — and we’ll save your payment method to make it even quicker the next time around.

If you’ve got money set aside in a Jar, you can now send it straight from there, without needing to withdraw it to your balance first.

If you frequently pay the same person but different amounts each time, this one’s for you. You can now edit the amount on your repeat transfers. Just tap a previous transfer and select ‘change’.

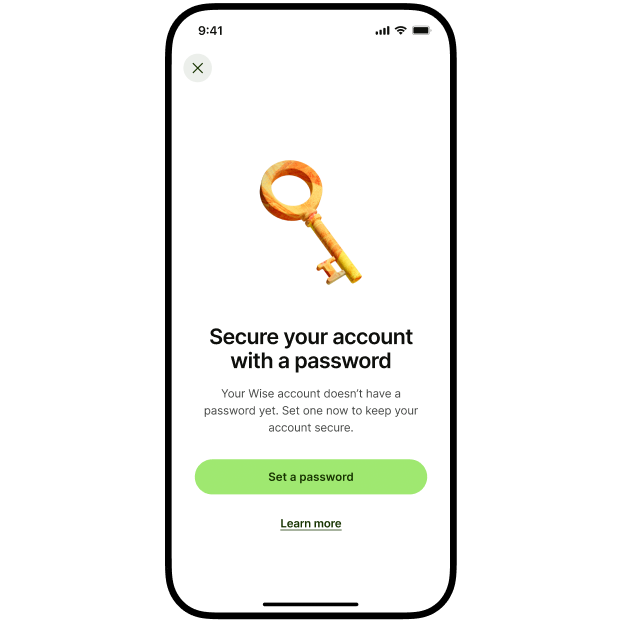

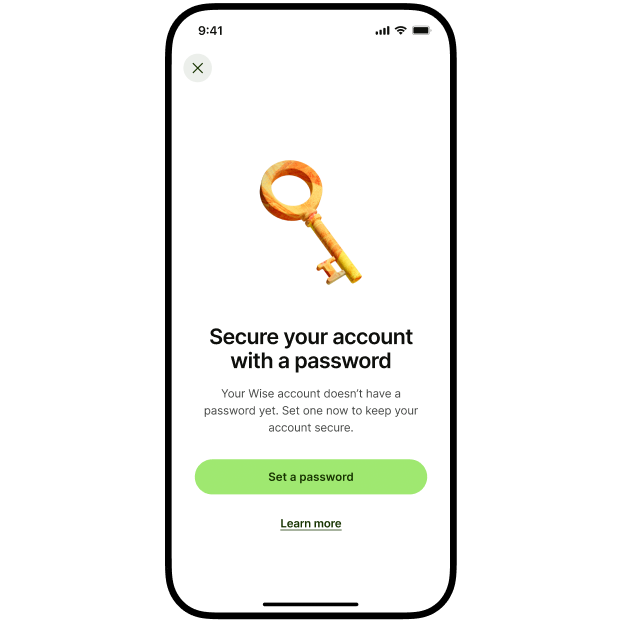

We’re making Wise accounts more secure, so you’ll now need to create a password if you’re logging in or signing up to Wise using Apple, Google or Facebook. Because only you should be able to access your money.

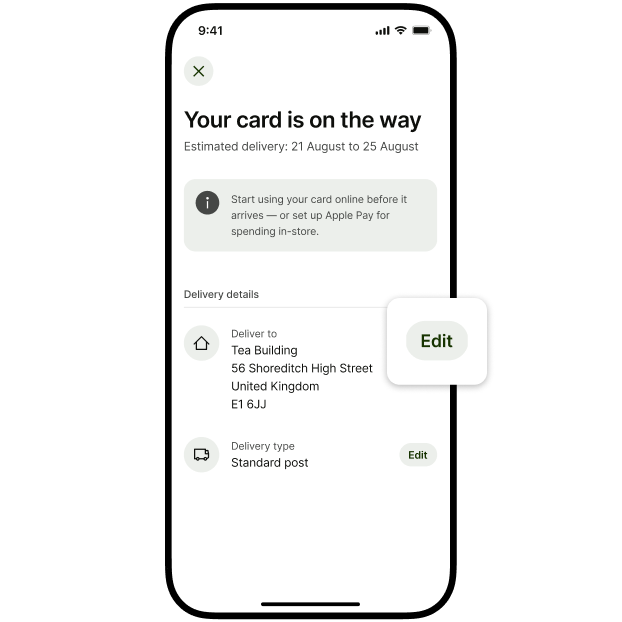

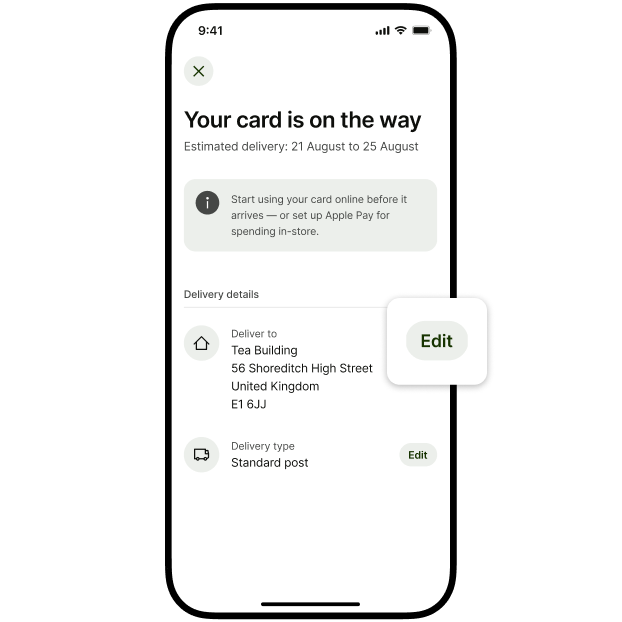

Ordered a new card but need to make some changes? You can now edit your delivery address and change to express delivery from the app — even if your card’s already been shipped. We’ll just charge a small fee to ship your new one.

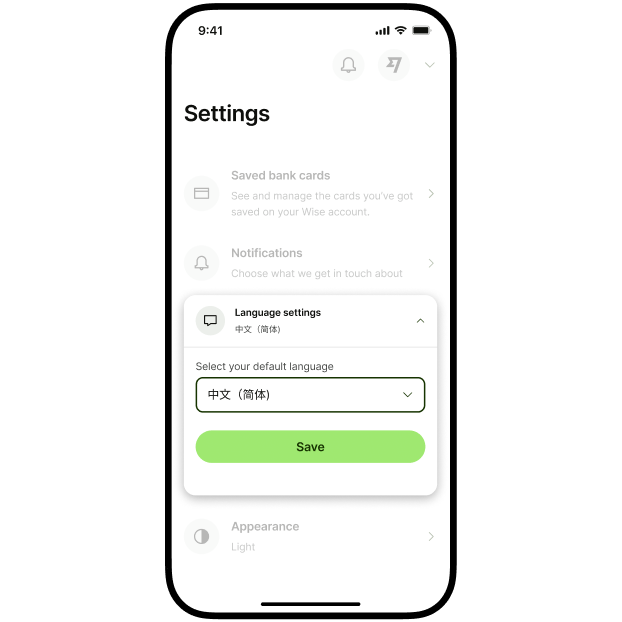

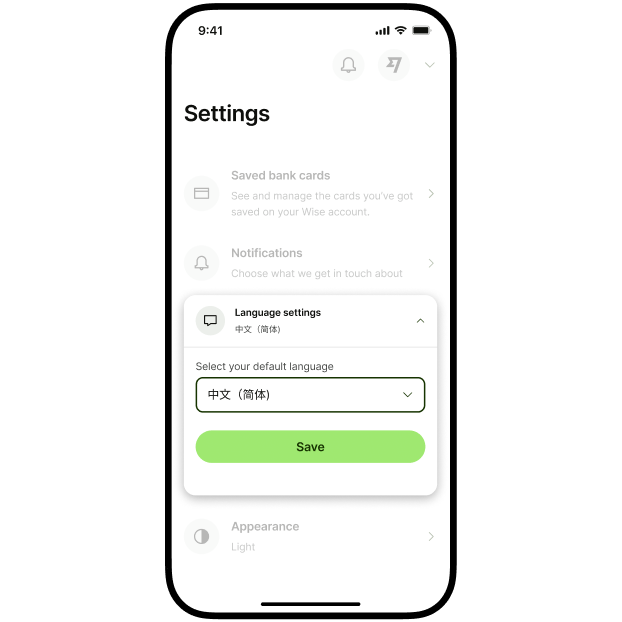

You can now set the language on your account to simplified Chinese. On the website, click ‘Settings’ and then ‘Language Settings’. If you’re using the app, you’ll find this under your phone settings for iOS and within your app settings for Android.

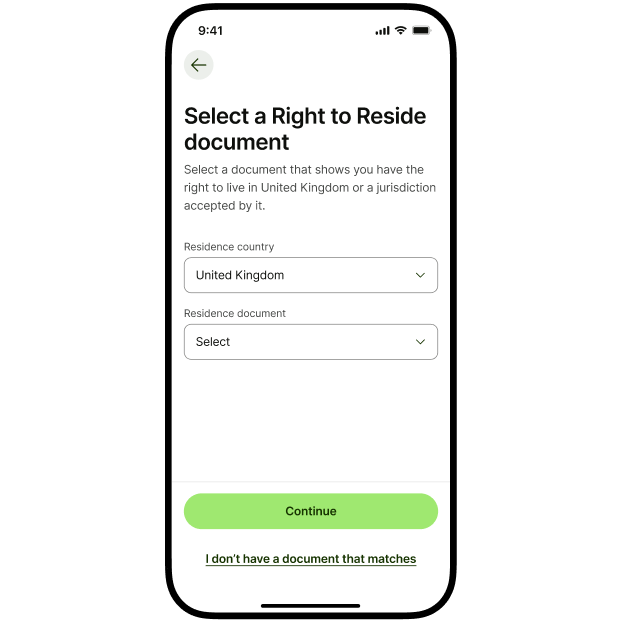

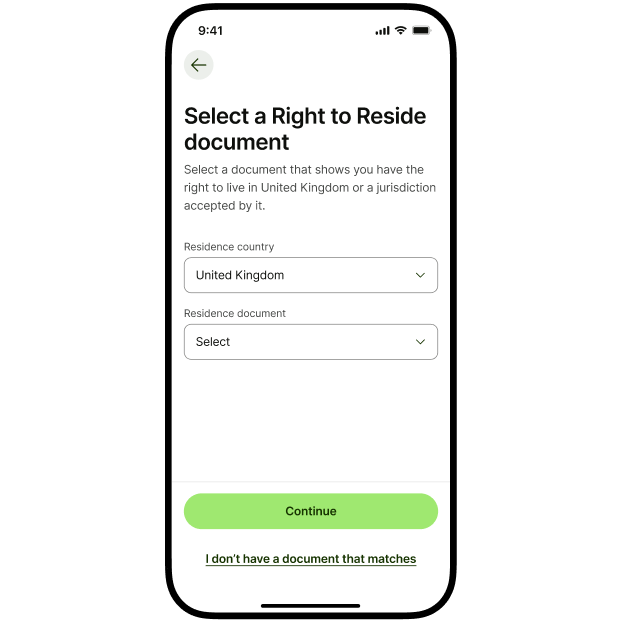

If you request USD account details for the first time, we’ll now carry out some additional checks to verify your country of residence. It’s part of our work to stop fraudsters from using Wise.

We’re making Wise accounts more secure, so you’ll now need to create a password if you’re logging in or signing up to Wise using Apple, Google or Facebook. Because only you should be able to access your money.

Ordered a new card but need to make some changes? You can now edit your delivery address and change to express delivery from the app — even if your card’s already been shipped. We’ll just charge a small fee to ship your new one.

You can now set the language on your account to simplified Chinese. On the website, click ‘Settings’ and then ‘Language Settings’. If you’re using the app, you’ll find this under your phone settings for iOS and within your app settings for Android.

If you request USD account details for the first time, we’ll now carry out some additional checks to verify your country of residence. It’s part of our work to stop fraudsters from using Wise.

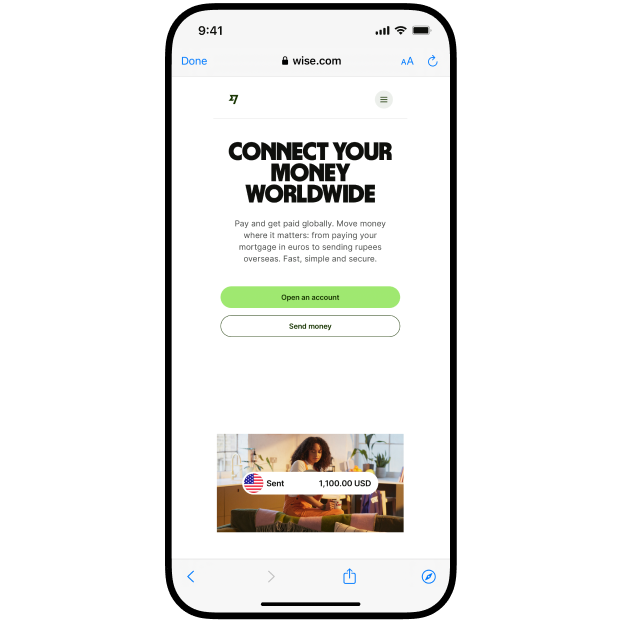

Recommending Wise to a friend in the US? We’ve updated our website with an improved US homepage that’s more relevant to US customers. We’ve added localised content, including the most popular currencies routes and US-specific case studies to help better explain how we can help them manage all their international money needs.

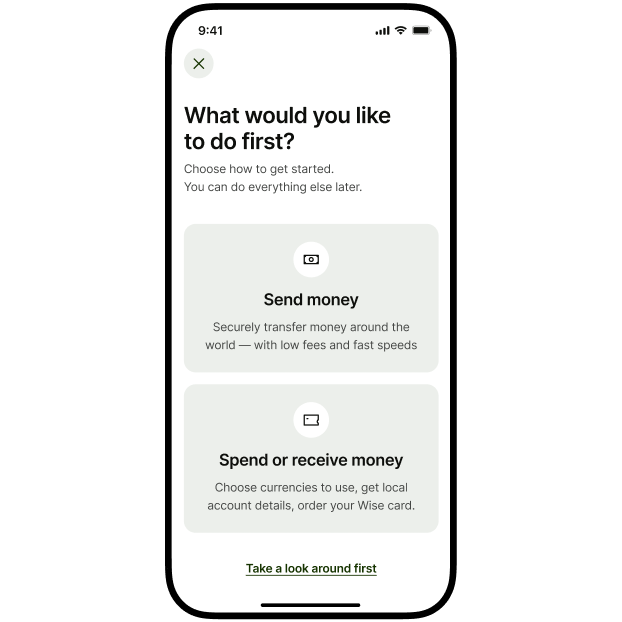

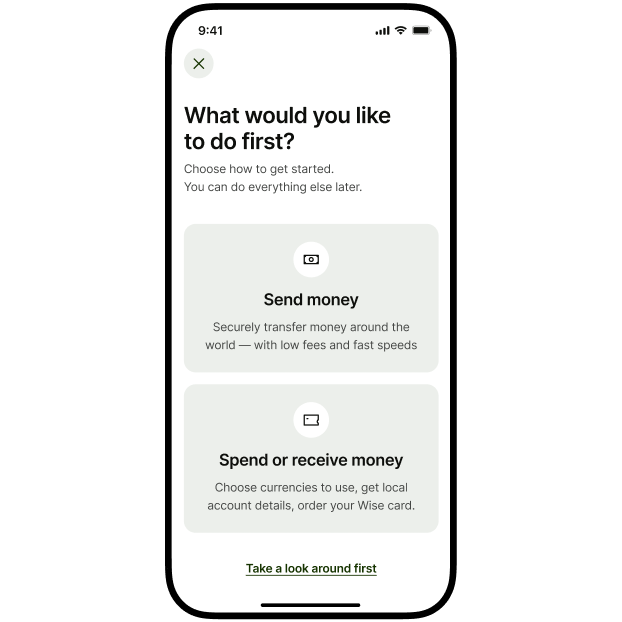

You told us getting started with Wise was overcomplicated and confusing. So we’ve streamlined it. New customers will now have the choice to either just send money or to open a Wise account for spending, receiving, converting and sending money. So if you’re referring a friend, it’s easier than ever for them to get started.

Recommending Wise to a friend in the US? We’ve updated our website with an improved US homepage that’s more relevant to US customers. We’ve added localised content, including the most popular currencies routes and US-specific case studies to help better explain how we can help them manage all their international money needs.

You told us getting started with Wise was overcomplicated and confusing. So we’ve streamlined it. New customers will now have the choice to either just send money or to open a Wise account for spending, receiving, converting and sending money. So if you’re referring a friend, it’s easier than ever for them to get started.

*Savings estimates are based on the average savings Wise offers compared to all the collected providers we have on the transactions transfer route from 01/01/24 to 30/03/24.

**Past performance is not an indicator of future performance. For full 5 year past performance of the funds, please visit our website.

***Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

****The price provided is a global average based on a fixed basket of representative currencies as of Q1 2024 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information accurate pricing information in your region.

*****Product currently not available for US residents.