Wise ACH vs wire guide

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

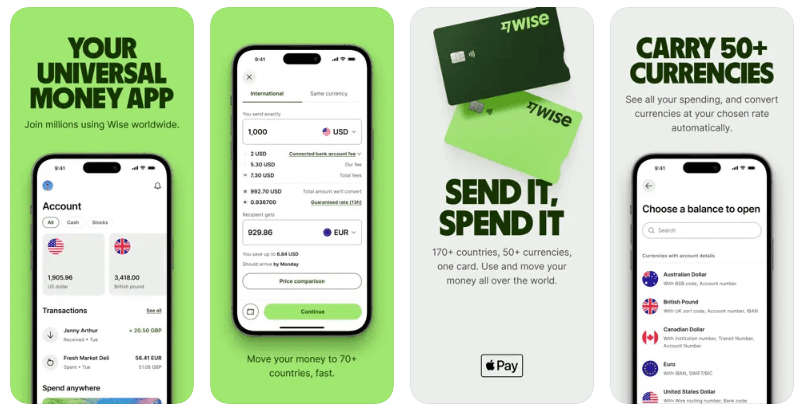

With Wise you can hold and exchange 50+ currencies, send money to 80+ countries, cheaper and easier than with old school banks, and spend in 170+ countries with your Wise international debit card.

Ready to open a Wise Account to send payments or hold a foreign currency balance? Here’s what to do.

| 📑 Table of contents |

|---|

Wise — formerly known as TransferWise — is a specialist in low cost currency conversion, and flexible multi-currency accounts for personal and business customers.

Whether you want to hold a foreign currency balance, or make a one off payment, you’ll first need to open an account with Wise. Let’s look at what you need to do:

Register with Wise online, or by downloading the handy Wise app. Look for the Register button, click, and enter your email address. To make it even easier, you can also sign up using a Google, Facebook or Apple account.

- Your passport (photo page only)

- Your national ID card (both sides)

- Your driver's license (both sides)

Once your Wise account has been verified, you can set up your payment by entering either the amount you want to send, or the amount your recipient should receive, online or in the Wise app. You’ll get an instant quote and estimated delivery time, so you can compare your options, and make your payment.

To keep customers and their money safe, and to comply with financial regulations in the US and around the world, Wise must verify customers' identity.

Whenever a verification step is needed, you will be prompted with which information or documentation will be required in order to follow through with your transaction.

It’s easy to open your Wise Account online or in the Wise app, to send money to 80+ countries with the mid-market exchange rate and low, transparent fees.

And while international payments with old school banks can be slow and expensive, Wise transfers are fast, with no surprise fees and no hassle.

Over 50% of Wise transfers arrive instantly, with 90%+ getting where they need to be in 24 hours or less¹.

Ready to get started? Check out our pricing and fee calculator to learn more about sending, receiving and exchanging currencies with Wise.

Sending online payments isn’t the only thing you can do with Wise. You can also choose to open currency accounts, which at Wise are called balances, to get paid from 30+ countries using local transfers, to hold 50+ currencies and switch between them in just a few taps. Here’s how to open a currency account in the Wise account, to get you started.

Create your Wise account easily online or in the Wise app with just an email address, or your Google, Facebook or Apple account.

Next you’ll be asked to verify your identity by uploading an image of your ID documents, and a selfie². This can be done easily online or right from your smartphone, with on screen prompts to guide you every step of the way.

If you don’t have what you need to hand, you can just save your progress and return to it later — and the Wise support team is on hand if you have any queries or challenges along the way.

Once your account has been verified you can set up your currency balance.

- Log into your account and click Open a balance

- Find and select the currency you wish to hold money in

If you're based in the US and create a balance in USD, EUR, AUD, NZD, GBP, HUF, RON, CAD, TYR and SGD you can also get details to get paid like a local in these currencies.

In order to get local details you need to:

1. Open Wise and log into your account

2. Find the balance you need and click on Get account details

3. You'll be prompted to top up your account. This first top up can be in any currency you'd like to have available, but the minimum amount should be 20 GBP or equivalent in another currency. The full balance will be available for you to spend after

4. Add money using your bank account, Apple Pay, credit or debit card

5. Besides topping up your account, Wise will need to verify you. This means they might ask for additional details or documents from you³

6. Once you're fully verified, you'll be able to access your local details!

To receive money, just share your unique account details with the sender. They’ll be able to deposit money into your account directly.

You can find the shareable details anytime. All you have to do is pick the currency you wish to get paid in, click on Receive and View and share account details.

Receiving money into your Wise balances is free with the exception of incoming USD wires, for which there's a fixed charge of 4.14 USD.

If you need to send, receive, hold or exchange international payments, you may be better off with a Wise Account.

Wise lets you hold 50+ currencies safely, and switch between them on the go in the Wise app. You’ll also get local account details for up to 10 currencies, to receive local payments from 30+ countries.

Whether you want to send money to a friend overseas, pay an international bill, or withdraw a foreign currency back to your local USD account, you’ll get the mid-market exchange rate every time, with no markups and no surprises.

There’s no monthly fee to pay, and no minimum balance — just straightforward transparent fees which make it easy to see what you’re really paying whenever you transact. See how much you can save with Wise today⁴.

Get your Wise Account

in minutes 🚀

💡 Did you know that Wise also offers a business account?

| Some key features of Wise Business include: |

|---|

|

Discover the difference between

Wise Business vs Personal

Opening a Wise account to make payments, or setting up a Wise currency balance to hold and get paid in foreign currencies is easy. With just your laptop or smart device you can register, get verified, and access all the services you need to manage your money across currencies for less.

Notes:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Learn all about how the Wise card compares to no FTF ones.

Can you use a Wise Account to convert money you earn?

See how the Wise card compares with Chase Sapphire in our complete guide

Discover in detail whether your account information is visible to the recipient when you make a payment through Wise.

Not sure if Instarem or Wise is the best option for you in the US? Check our guide and find out.